Data Science

Why is data important to marketplace optimisation?

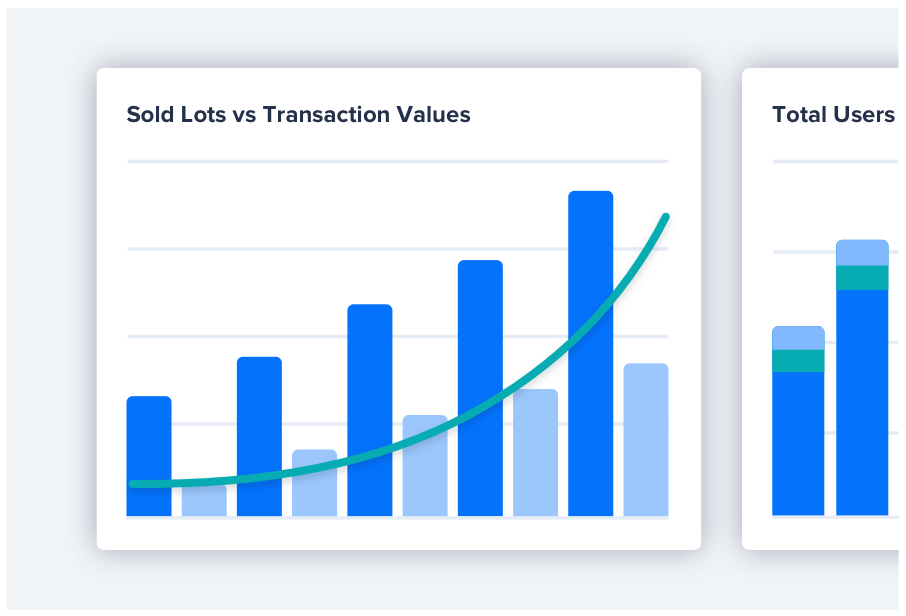

Organisations should not downplay the role of data, by adopting a data-driven approach, businesses can take sales information and leverage it as a strategic asset, generating actionable commercial insights and unleash their true sales power.

Live margin estimates for car auctions

Better distribution of bids on your inventory

Less frustrated buyers

Encourage more visibility of your inventory

Sell more, faster